Cheapest home loan rates

When a person is researching buying a house, there’s countless factors to consider. As a real estate agent, questions I often hear is what’s the market doing these days? Will a bubble burst and prices go down? One of the biggest questions most buyers have is who, how, and where do I get the cheapest home loan rates?

When a person is researching buying a house, there’s countless factors to consider. As a real estate agent, questions I often hear is what’s the market doing these days? Will a bubble burst and prices go down? One of the biggest questions most buyers have is who, how, and where do I get the cheapest home loan rates?

Before answering that question about the cheapest home loan rates, let’s review the basics.

*****Disclaimer, Reel Property Solutions, LLC along with Rochelle, a licensed real estate agent with eXp Realty, is not a mortgage loan officer nor a mortgage loan broker and cannot quote any rates for anyone. See your preferred lender for details or contact us to pass along information for lenders in Minnesota.

What is a mortgage? Directly from https://www.bankrate.com/mortgages/mortgage-rates/ states:

Benefits of a mortgage?

- Tax advantages (consult a professional tax adviser for more information)

- Helping an entity maintain a strong business worth

- Paying smaller bits of payments over time to create better affordability

Downfalls of a mortgage?

- Paying interest

- May not be able to sell house quickly due to how much equity verses appraised value is in the property

- House is used as collateral; therefore, late payments could result in the house being taken away from the homeowner

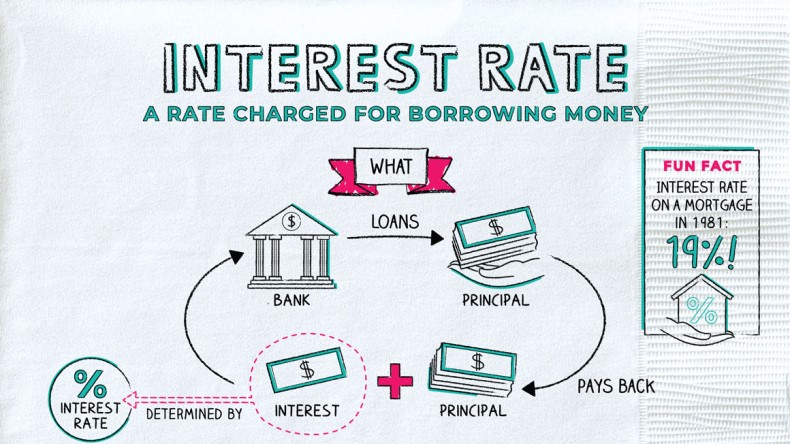

Why is interest charged?

Think of this perspective: You loaned out a large lump sum of money and the person is expected to repay in monthly installments. How should you be compensated for your generosity, time, and risk for lending that money? Yup, that’s why interest is charged. Mortgage lenders are generous to loan money. There’s only so much they have access to which is why not everyone is qualified for a loan. Next, a lender’s time of having that money out needs to be compensated. Finally, the biggest part is risk. Even though there are legal documents stating the homeowner will repay, there’s always the “what if’s” that could pop up to prevent repayment.

How is interest determined?

Talk to a lender for the specifics. Generally, current income, downpayment saved, and past credit history are the big indicators to start. In short, the higher the income, the bigger the downpayment and the cleaner the past credit history, probably the lower the interest rate.

What if I can pay off the mortgage early?

Congratulations! Now talk to your lender about prepayment penalties. Perhaps talk to your tax professional who can give advice about tax repercussions.

What if I have enough money to buy a house without a mortgage?

That’s great! When purchasing a property, you will need a Proof of Funds from your financial institution. Ensure there is contact information so those funds can be verified.

I still have a mortgage on my house, but I want to move and can’t pay off the current mortgage. What can I do?

Great question, that’s why I’m here to guide you! First, what is the payoff amount and what other liens need to be paid off? Be HONEST with yourself and all parties involved about what liens are on the property. This link is a blog about a time when Reel Property Solutions, LLC wasn’t able to close a property because the homeowner wasn’t honest about with themselves about the number and amounts of liens tied to the property which in return turned into a disastrous financial, credit, and homeowner’s self-esteem situations. Do you have enough equity to justify selling? For example, what if you bought the house for $125,000, you have $100,000 to pay off and you think you can resell for $150,000? These are some factors to consider: 1) What is the local market doing? What are the neighbors selling for? 2) Will your property appraise for $150,000? 3) Do some quick math. Let’s say you can sell for $150,000. So $150,000-$100,000= $50,000 minus the broker’s commission (in this case, let’s say 6% which is $9,000) minus payoff other liens (but not in all circumstances) minus closing costs (let’s say for easy math it’s $5,000) for this transaction. The final number could be about $36,000 in the homeowner’s pocket. But another scenario may not be so great. For example, what if this same situation also had a mechanic’s lien of $30,000? So now that amount is repaid to the lien holder, therefore the homeowner walks away with approximately $6,000. Worth selling or not? Here’s a final no-brainer, can’t sell situation: same amounts as above with the mechanic’s lien. Instead of thinking the house could sell for $150,000, the local market says sell for $130,000. Now with the calculations of the broker’s commission, the payoff amount, the lien holder payback and closing costs, the homeowner is under water. The final pay off amount and any lien holders will determine the answer.

If a homeowner is feeling the need to sell but realizes they do not want to be represented by an agent to waive that commission fee, Reel Property Solutions, LLC has other options as well such as a cash transaction through a title company or real estate attorney. Reel Property Solutions, LLC has extensive education through Fortune Builders who teaches real estate investors all the nuances of how to have a successful transaction (provided everyone is honest!). In addition to a cash transaction, there are other perks that can be part of the purchase to assist the homeowner/selling representative. Talk to us for the specifics for your unique situation.

To answer the question: When is the best time to apply for a mortgage for the cheapest home loan rates?

Most likely NOW! 2020-2021 cheapest home loan rates hovering 3% or lower, but in late 2021 Feds realizing they need to raise rates. Rates can’t stay historically low forever! This also indicates 2022 rates are on the rise. Even though rates may not increase dramatically, keep in mind that a 30 year mortgage of paying interest adds up fast, so that 1% fluctuation could be a significant number in the end.

What should I keep in mind when applying for a mortgage?

Ensure you have the financial stability for a mortgage. People with credit history glitches such as high debt-to-income ratios, late payments, debt collections, etc. most likely will not qualify for the cheapest home loan rates.

If you are interested in selling your home whether off market with a cash offer or represented with an agent, Reel Property Solutions, LLC is brokered by eXp Realty, so the sky is the limit with options! For any questions about a professional mortgage lender, Rochelle works with a long list of reputable lenders who all have various perks to suit the home buyer’s needs to get the cheapest home loan rates.

Remember that every situation must be a WIN-WIN for all involved so that everyone can CATCH A WINNER!

info@reelpropertysolutionsllc.com

507-218-8788

rochelle.markov@exprealty.com

507-358-0638